Navigating the complexities of international trade is no small feat, especially when it comes to the intricate world of LED products. The Harmonized System (HS) codes are more than just strings of numbers—they are the backbone of international trade, a global language that facilitates seamless communication across borders.

For businesses involved in the trade of LED products, mastering HS codes is not merely an administrative task; it’s a critical component of operational success. Incorrectly classified goods can lead to delays, unexpected costs, and even legal penalties. On the other hand, accurate classification can streamline your supply chain, reduce costs, and provide a competitive edge in the global market.

In this comprehensive guide, we will delve deep into the intricacies of HS codes as they pertain to LED products. Whether you’re new to the field or looking to refine your understanding, this guide will equip you with the knowledge you need to ensure your trade operations are both efficient and compliant.

What Are HS Codes?

HS codes are essential in international trade, serving as the universal language for classifying products. Understanding these codes is critical for anyone involved in the import or export of goods, particularly in the LED industry.

The Harmonized System (HS) Overview

The Harmonized System, or HS, was developed by the World Customs Organization (WCO) to standardize the classification of goods traded globally. Nearly 200 countries use this system, making it the backbone of international trade. Each product is assigned a unique six-digit code that helps customs authorities worldwide identify and classify it correctly. This standardization simplifies the movement of goods across borders, reducing errors and delays.

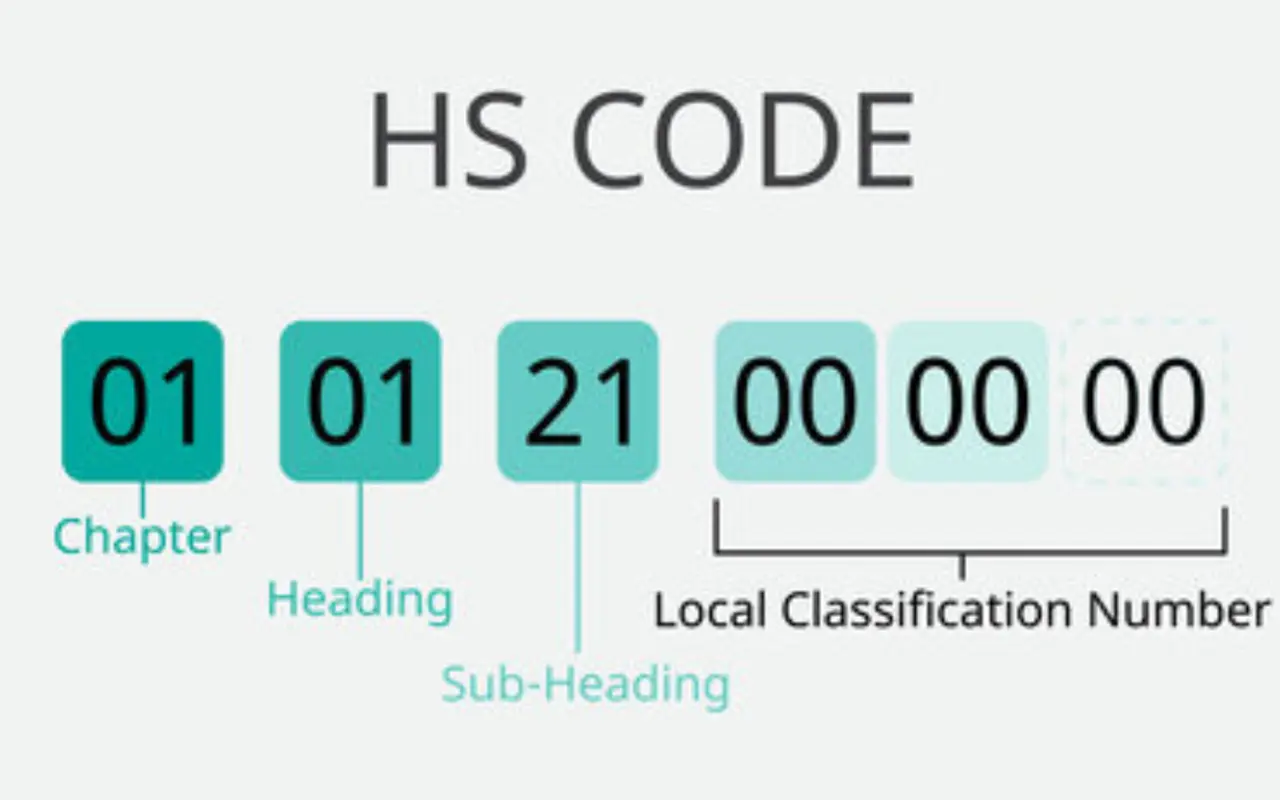

Understanding HS Code Structure

HS codes are structured to provide detailed information about the product being classified. The first two digits represent the chapter, which is a broad category of products. The next two digits represent the heading, which narrows down the product type, and the final two digits indicate the subheading, which provides further specificity.

Subheadings within HS codes allow for even more precise classification of products. For example, within the category of LED lighting, there may be different subheadings for bulbs, fixtures, and modules, each with its specific code.

Importance of HS Codes in Trade

HS codes play a vital role in determining customs duties and taxes. The correct classification of products ensures that the appropriate tariffs are applied, which can significantly affect the cost of importing or exporting goods. Misclassification, on the other hand, can lead to underpayment or overpayment of duties, both of which can result in penalties, fines, or even legal action.

In addition to their impact on customs and tariffs, HS codes are crucial for effective supply chain management. Accurate classification allows companies to track goods as they move through the supply chain, ensuring that they comply with local regulations and arrive at their destination without unnecessary delays. This precision is particularly important for LED products, which are often subject to strict regulatory standards.

HS Codes for LED Products

The classification of LED products under HS codes can be complex due to the wide variety of items and technologies involved. However, understanding these codes is essential for ensuring compliance and optimizing your trade operations.

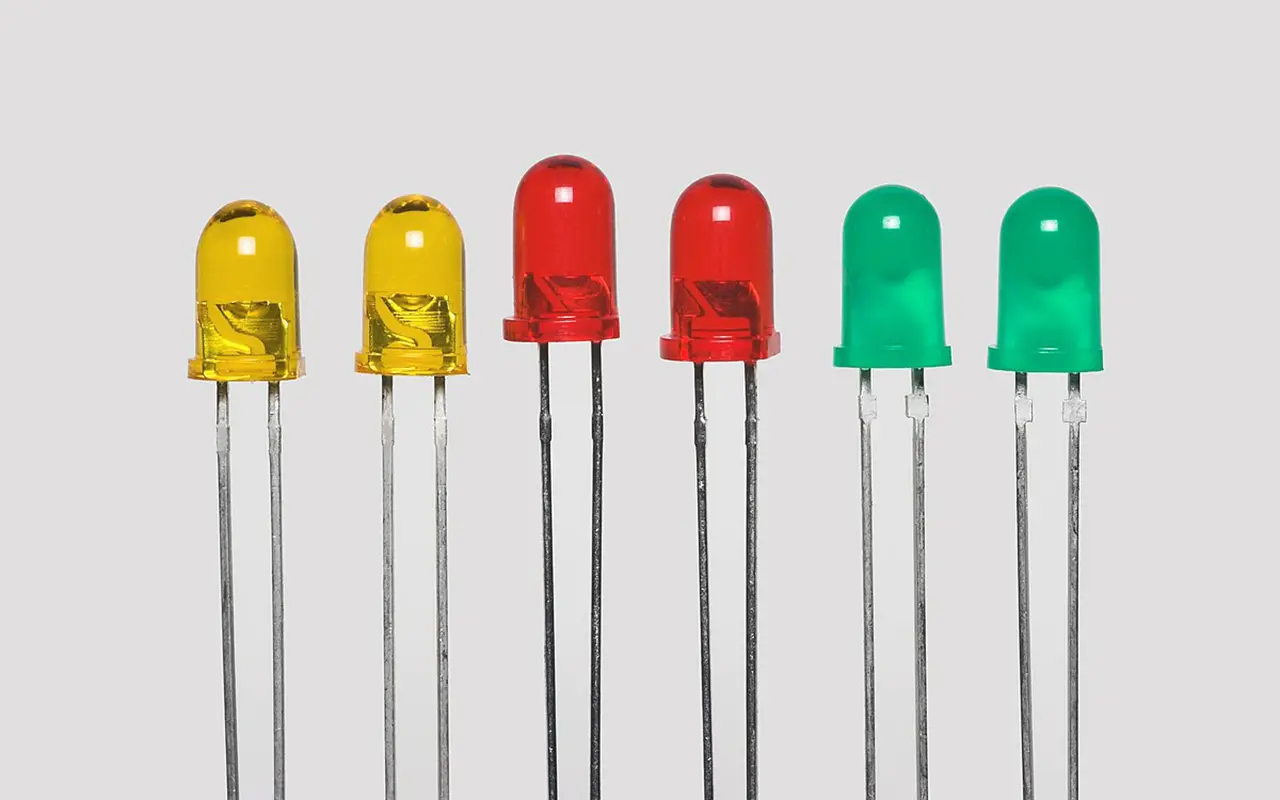

Classifying Light Emitting Diodes (LEDs)

HS Code 8541.40 for LEDs

LEDs themselves are classified under the HS code 8541.40. This code applies to light-emitting diodes used in a variety of applications, from residential lighting to automotive and industrial uses. Accurate classification under this code is crucial for determining the correct tariffs and ensuring compliance with international regulations.

Key Considerations for Classification

When classifying LEDs, it’s essential to consider factors such as the intended use, the type of LED, and whether the product is sold as a standalone component or as part of a more complex assembly. These details can affect the specific subheading under which the product falls, impacting the applicable duties and compliance requirements.

HS Codes for LED-Related Products

Codes for Integrated LED Products

Integrated LED products, such as LED bulbs or lamps, often fall under different HS codes than standalone LEDs. For instance, LED lamps are typically classified under HS code 8539.50, which covers electric lamps and lighting fixtures. The exact classification can vary depending on factors like the product’s design and application.

Accessories and Peripheral Devices

LED accessories, such as drivers, connectors, and profiles, each have their own specific HS codes. For example, LED drivers, which control the power supply to LEDs, are classified under HS code 8504.40. Accurate classification of these accessories is crucial for ensuring compliance and avoiding customs issues.

HS Codes for LED Lighting Products

LED lighting products are a significant part of the LED industry, with a wide range of applications from residential to industrial settings. Understanding the correct HS codes for these products is essential for smooth international trade.

LED Lamps

HS Code 8539.50 for LED Bulbs

LED bulbs, widely used in both residential and commercial settings, are classified under HS code 8539.50. This code covers a variety of electric lamps, making it the go-to classification for most LED bulbs. Proper classification under this code ensures that the correct tariffs are applied and that the product complies with local regulations.

Codes for Various Lamp Types

While many LED lamps fall under the 8539.50 code, it’s important to note that specific types of lamps, such as those used in industrial or commercial settings, may have different classifications. For example, specialized industrial LED lamps may require a different code based on their specific use and design features.

LED Light Fixtures

HS Code 9405.40 for Fixtures

LED light fixtures, which house or incorporate LED bulbs, are classified under HS code 9405.40. This code applies to various types of fixtures, including downlights, spotlights, and panel lights. Accurate classification of these fixtures is essential for ensuring compliance and optimizing tariff calculations.

Specialized Fixtures

Some LED fixtures, such as those used in specific industries or applications, may require unique HS codes. For example, fixtures designed for hazardous environments may fall under a different classification due to their specialized construction and safety features.

LED Modules

Defining LED Modules and Codes

LED modules, which consist of one or more LED chips mounted on a circuit board, are classified under HS code 8541.40. These modules are used in a variety of applications, including architectural and industrial lighting. Proper classification is crucial for ensuring compliance with international trade regulations.

Differences from Complete Fixtures

It’s important to distinguish between LED modules and complete fixtures. While modules are classified as components, complete fixtures have their own classifications. This distinction is critical for accurate tariff calculations and compliance with local regulations.

LED Strips & Neon Lights

Flexible LED strips, commonly used for decorative lighting, fall under HS code 9405.40. These strips are popular for their versatility and ease of installation, making them a common choice for both residential and commercial projects (LED strips in the bedroom light). Accurate classification under this code ensures that the correct duties are applied during import or export.

Codes for Neon LED Lights

Neon LED lights, which mimic the appearance of traditional neon but with greater energy efficiency, are also classified under HS code 9405.40. These lights are used in a variety of applications, from signage to architectural lighting, and proper classification is essential for ensuring compliance.

HS Codes for LED Display Products

LED display products, such as screens and video walls, are an integral part of modern advertising and entertainment. Correct classification under HS codes is crucial for avoiding delays and penalties during international trade.

LED Display Panels

HS Code 8528.59 for Displays

LED display panels, which are used in everything from digital billboards to event production, are classified under HS code 8528.59. This code covers a wide range of display technologies, ensuring that LED panels are accurately classified for tariff and compliance purposes.

Applications Across Industries

LED displays are used across various industries, including retail, sports, and entertainment. Each application may have specific requirements for classification, and understanding these nuances is essential for smooth trade operations (LED display panels in Times Square).

Specialty LED Displays

Codes for Transparent and Flexible Displays

The HS code for LED displays, including transparent and flexible types, generally falls under the broader category of “Display devices, not elsewhere specified or included” under HS Code 8528. However, the specific sub-category can vary based on the exact characteristics of the product.

For transparent and flexible LED displays, the most common HS code used is 8528.59, which covers “Other monitors and projectors, not incorporating television reception apparatus.” However, the exact code can differ depending on local regulations and the specific use case of the product.

In some cases, LED displays designed for specific environments, such as outdoor or industrial settings, may require different classifications. Understanding these special use cases is key to ensuring compliance and avoiding customs issues.

It’s crucial to consult with a customs expert or use the official HS classification tools provided by the World Customs Organization (WCO) or national customs authorities to determine the most accurate code for your specific product. The HS code might also be influenced by factors like screen size, resolution, and whether the display is integrated into another product.

HS Codes for LED Components

LED components, including drivers, power supplies, and connectors, are essential parts of LED systems. Proper classification of these components is crucial for ensuring compliance and avoiding delays in international trade.

LED Drivers and Power Supplies

LED drivers and power supplies are critical components that regulate the electrical current to ensure optimal performance and longevity of LED systems. These are classified under HS code 8504.40, which covers electrical apparatus for switching or protecting electrical circuits, or for making connections to or in electrical circuits. This category is broad, encompassing various types of power regulators essential for LED operations.

LED Controllers

Controllers, which are responsible for managing the functionality of LED systems, can vary widely in their design and application. These controllers might adjust brightness, color, or timing sequences in LED displays or lighting systems. The HS code for LED controllers typically falls under HS code 8537.10. This code specifically covers boards, panels, consoles, desks, cabinets, and other bases for electric control or distribution of electricity, which are designed for the control of lighting systems.

LED Chips

LED chips are the core components responsible for generating light in an LED system. These semiconductor devices are classified under HS code 8541.40, which specifically covers light-emitting diodes (LEDs), including laser diodes.

LED Connectors

LED connectors are vital for creating reliable electrical connections between different LED components, such as strips, modules, and power supplies. These connectors typically fall under HS code 8536.90, which covers electrical apparatus for switching or protecting electrical circuits, including connectors for electrical circuits.

LED Wires

LED wires, which transmit electrical power and signals between LED components, are classified under HS code 8544.42. This code covers insulated electric conductors, specifically those for a voltage not exceeding 1,000 volts.

HS Code Reference Table for LED Products

Common HS Codes for LED Lighting

| Product | Category Description | HS Code |

|---|---|---|

| LED Lamps | Electric discharge light bulbs | 8539.50 |

| LED Light Fixtures | Metal ceiling or wall lighting fixtures | 9405.40 |

| LED Modules | Light-emitting diodes (LEDs) | 8541.40 |

| LED Strips | Flexible linear lighting solutions | 9405.40 |

| LED Neon Lights | Flexible neon-style LED lights | 9405.40 |

LED Display Products and Components

| Product Category | Description | HS Code |

|---|---|---|

| LED Display Panels | Digital billboards and event screens | 8528.59 |

| LED Drivers | Electrical devices controlling LED current | 8504.40 |

| LED Power Supplies | Electrical devices controlling LED current | 8504.40 |

| LED Controllers | Devices managing LED system functionalities | 8537.10 |

| LED Chips | Core components for LED light production | 8541.40 |

| LED Connectors | Electrical connectors for LED systems | 8536.90 |

| LED Wires | Insulated electrical cables for LED systems | 8544.42 |

Staying Updated on HS Code Changes

Tools for Tracking Changes

There are several tools available for tracking changes to HS codes, including online databases and subscription services from trade organizations. These tools can help you stay informed about updates and ensure that your products are always classified correctly.

Proactive Compliance Measures

Proactive compliance measures, such as regular audits of your product classifications and ongoing training for your team, can help prevent issues before they arise. By staying ahead of changes to HS codes, you can ensure that your trade operations remain smooth and compliant.

Educating Your Team

Educating your team about the importance of HS codes and how to accurately classify products is essential for maintaining compliance. Regular training sessions can help ensure that everyone involved in the trade process is up to date on the latest regulations and best practices.

Conclusion

Understanding and correctly applying HS codes is crucial for anyone involved in the international trade of LED products. These codes are more than just numbers—they are the key to ensuring smooth customs processes, accurate tariff calculations, and compliance with global regulations. By staying informed, using the right tools, and seeking expert guidance when necessary, you can navigate the complexities of HS codes and keep your trade operations running smoothly. Stay updated on changes, educate your team, and leverage technology to ensure that your products are always classified correctly, avoiding the risks and disruptions that can come with misclassification.

In conclusion, mastering HS codes is key to smooth international trade in LED products. As one of China’s top manufacturers of LED strip lights and LED neon flex, Unitop offers the expertise you need. If you have questions or specific requirements, contact us today. We’re here to help you navigate the complexities and succeed in the global market.

Tom is now the Sales Manager of Unitop (China) Co., Limited. He has been in the LED Lighting industry ever since 2005. He is an expert in sales & marketing, and factory management. He likes bodybuilding, and he is also a crazy Apple Fan! He is a hard-working guy and loves to learn and try new things.

Email: tom@unitopledstrip.com WhatsApp: +86-18680307140

Leave a Reply

Want to join the discussion?Feel free to contribute!